JOHANNESBURG (miningweekly.com) – South African investment management company Fairtree Asset Management now holds more than 5% of the ordinary shares of gold mining company Harmony Gold, the company stated on Monday.

The Cape Town-based Fairtree, which describes itself as a ‘long-only’ investment manager, has more than R75-billion combined assets under management.

Harmony, South Africa’s third-largest gold-mining company, last week announced its intention to place, through an accelerated bookbuild process, authorised, but unissued, shares in the company to qualifying investors who agreed to subscribe for about $200-million.

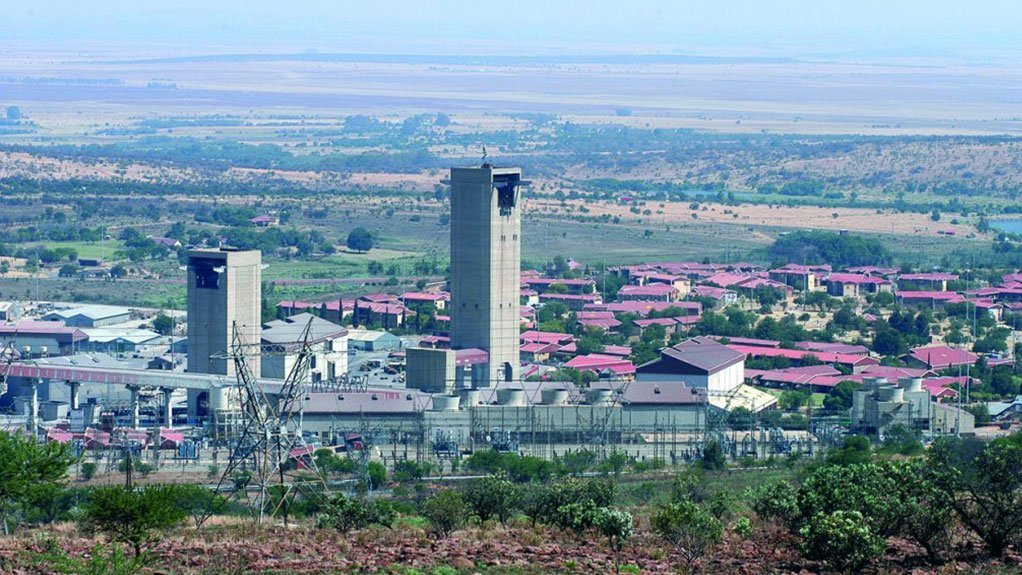

The placing, which represented 11.1% of Harmony’s issued ordinary share capital, was described by Harmony CEO Peter Steenkamp as a validation of investors’ support for the company’s stated strategy of safely growing quality ounces and increasing margins, specifically through the acquisition of the Mponeng and Mine Waste Solutions assets.

Collectively, the assets add more than 350 000 oz/y to the portfolio of the Johannesburg- and New York-listed Harmony.

A requisite majority of the shareholders earlier this month approved the equity raise at a virtual extraordinary general meeting conducted entirely through electronic communication in view of the Covid-19 pandemic and related restrictions issued under the Disaster Management Act.

As reported by Mining Weekly, Harmony executive director of business development Frank Abbott has expressed the belief that the dilution of shareholders as a result of the equity raise would be more than made up by the gold and the profits expected to be generated by the assets acquired from AngloGold, especially at current gold prices.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here